With the looming clouds of the coronavirus pandemic, differences can be observed. The most popular helpful change is the lockdown measures. During the lockdown, most people expected to save the extra bucks it cost them to travel to work. Others simply hoped to put a tight leash of their spending indulgences and focus on saving.

To analyze the effects the pandemic has on the American population’s saving habit, we carried out a survey and will look at the reports in this article.

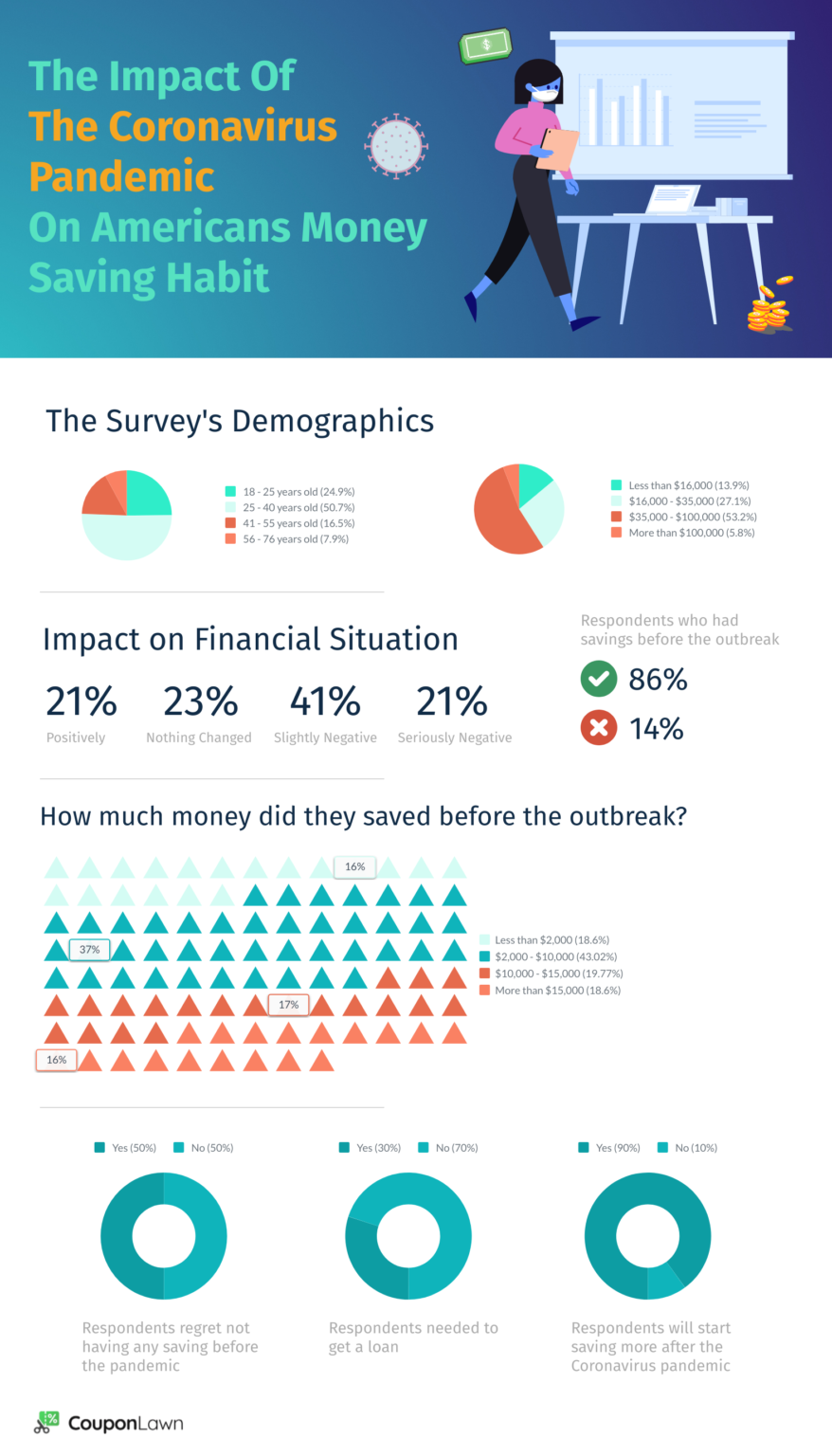

The Survey’s Demographic

The focus population of this survey was 1,094 male and female Americans between the ages of eighteen and 76 years.

Among these, 54.6% are male, and 45.4% are female.

For Income,

- 13.9% of the respondents earn less than 16,000 USD annually

- 27.1% of them earn around 16,000 USD to 35,000 USD

- 53.2% of the respondents earn approximately 35,000 USD to 100,000 USD

- 5.8% of them earn more than 100,000 USD annually

Survey Results

We asked the following questions during the survey, and here are the results:

How Has the Coronavirus Pandemic Impacted your Financial Situation?

Among these 1,094 Americans, 20.8% of them observed a positive change in their finances during the pandemic. 41.4% of them noticed slightly negative changes, while 15.3% observed seriously negative changes. Of this population, 22.5% saw no change in their finances.

It is easier to find motivational speakers than someone that has it all figured out in savings, so everybody just suggests what works for them. So, getting opinions on savings from experts is hard, but we will analyze these results based on tested working policies.

For an average American, the minimum wage without bonuses or incentives is 10.8 USD daily. Without other income sources or logging extra hours for rewards or incentives, the majority of the population of America will earn less than 10,000USD annually.

The pandemic affected the economy and increased prices of daily needs, coupled with the need to have goods delivered and pay for delivery; there is bound to be an increase in average expenses. It is normal to have a slight increase in total expenditure.

Did you Have Savings Before the Outbreak, and If Yes, How Much?

From the respondents, 85.9% had havings before the outbreak, while 14.1% had none.

A bigger fraction of people (36.5%) had savings of around 2,000USD to 10,000 USD. The following percentage, with less than 2,000 dollars, had 31.3%. The others had 16.6% and 15.5% for 10,000 USD to 15,000 USD and 15,000 USD and above respectively.

Most young adults save for specific purposes as opposed to rainy days, while adults usually save money for a rainy day. But, with the many responsibilities an adult has, sometimes these unforeseen expenses show up at best annually. So, typically having a large amount of savings means a substantial income, a pocket full of discipline, or fewer responsibilities.

If No, Do You Have Regrets or Need to Get a Loan?

The regrets scale was almost a 50:50 Balance, with 49.9% having no regrets and 50.1% with regrets.

69.6% did not need loans, while 30.4% did need loans.

For many people, saving feels unnecessary, and others never had enough left to keep or simply could not. Some psychologists would argue that a person’s personality type may affect how they view saving. A spontaneous personality type would be less inclined to save than a systematic personality type.

Are You Going to Start Saving More Money After the Coronavirus Pandemic?

90% of the respondents voted yes, while 10% of them voted no.

Based on differences in personalities and reactions to a crisis, some people realized they need to save while others probably realized life is too short. Crisis brings about different reactions in people that fuels their actions.

Limitations of the Study

First, a sample of 1,094 respondents does not properly represent the total population size of America. There is also no complete assurance that the respondents were candid while answering. Even the lack of many experts in the field of financial savings is a bit of a drawback.

However, this data was flawlessly organized with analytics tools, and the result does not reflect our opinions.

In conclusion, we hope the survey review helped you feel like you are not alone. If you want to share these findings with someone it will benefit, feel free to do so.